As of 1 January 2026, CBAM applies

From 1 January 2026, the final implementation phase of the Carbon Border Adjustment Mechanism (CBAM) begins. With the current CBAM Omnibus package, the EU has clarified key rules – including the 50-tonne threshold and new deadlines for registration and the purchase of certificates.

For importers of CO₂-intensive goods, this means: it’s time to set up and prepare internal processes now – otherwise things can get expensive from 2027 onwards.

The most important CBAM facts at a glance

- Start of the final CBAM phase: 1 January 2026

- Omnibus relief: New 50-tonne annual threshold – smaller importers are largely exempt from CBAM obligations, and a significant share of companies will benefit.

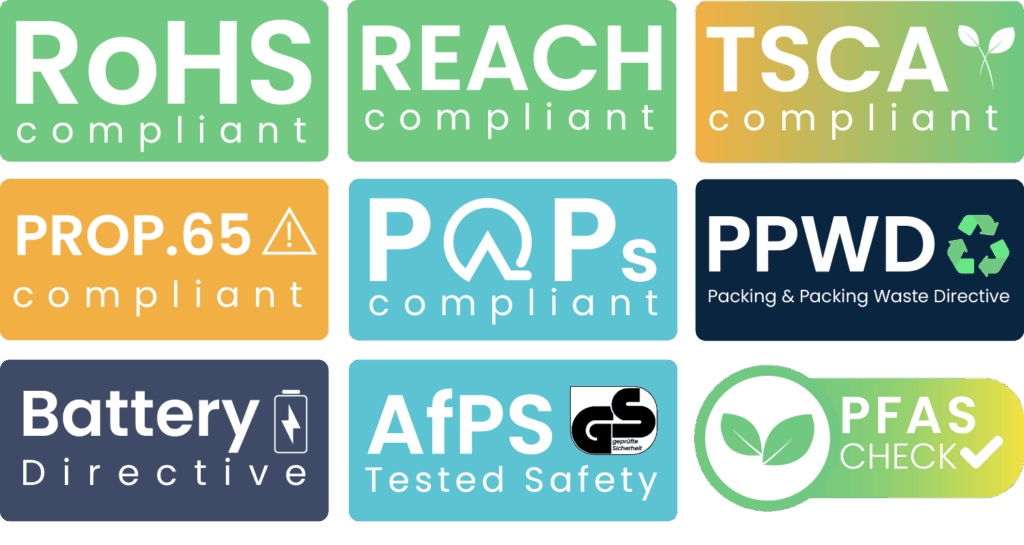

- Who is affected? Importers of cement, iron & steel, aluminium, fertilisers, hydrogen and electricity into the EU.

- Registration requirement: Only authorised CBAM declarants are allowed to release CBAM goods for free circulation.

- First payment obligation: CBAM certificates for the year 2026 can be purchased from February 2027; the first complete CBAM declaration is due by 30 September 2027.

Further information on CBAM can be found on the pages of the German Emissions Trading Authority.

What exactly does the Omnibus package change?

With the CBAM omnibus package, the EU is responding to experience from the transitional phase (October 2023 to the end of 2025) and introducing adjustments that make administrative processes easier – without weakening climate targets.

- 50-tonne threshold Companies that import less than 50 tonnes of CBAM goods per year are to be largely exempt from CBAM obligations. Many smaller importers will be relieved, while large emission volumes remain within the system.

- Pragmatic entry into the registration process Importers must register as authorised CBAM declarants. Companies that submit their application on time can, as a rule, continue importing while their application is being processed – an important factor for planning certainty.

- Adjusted deadlines for certificates and reports The sale of CBAM certificates for the first obligation year 2026 starts in February 2027, and the first CBAM declaration must be submitted by 30 September 2027 – and then annually.

For companies with significant material flows – particularly in steel, aluminium and fertilisers – CBAM therefore remains a strategically important core topic.

Who needs to act now

Directly affected are EU-based companies that release CBAM goods for free circulation – from manufacturers importing precursors to traders of finished goods. They should:

Indirectly affected are suppliers outside the EU: if no robust emissions data is available, importers must fall back on conservative default values – which is usually more expensive and worsens the competitive position of supplying installations.

Why CBAM doesn’t work without supply chain data

CBAM is not just a customs or tax project – it is a data project:

- Companies need to know which products and components contain CBAM-relevant materials.

- They need structured responses from suppliers, including production site, manufacturing process, precursors and emissions values.

- This information must be brought together and documented in a repeatable, auditable process – ideally integrated into the existing product compliance management.

Companies that establish these processes now not only reduce risks and administrative effort, but also lay the foundation for actively managing their carbon footprint and future CBAM costs.

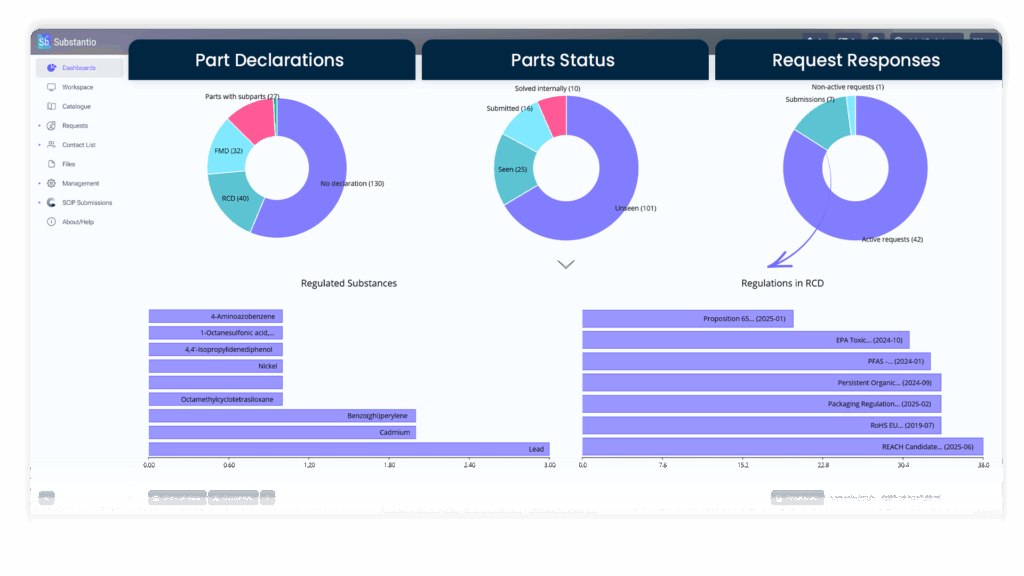

How Substantio supports you with CBAM

CBAM raises the same practical questions for many companies:

How do I obtain reliable data from my suppliers – and how do I turn that into a robust report for my CBAM filing? This is exactly where Substantio comes in.

1.

Standardised supplier questionnaire for CBAM-relevant raw materials

In Substantio, CBAM is mapped as a structured supplier questionnaire. Manufacturers can use it to:

- contact all relevant suppliers automatically directly from the software

- request information via a standardised form on:

- Country of Origin

- Production process / installation

- direct and indirect emissions (CO₂) of the supplied raw materials or precursors

The responses flow automatically into Substantio and are available there in a structured format for analysis.

2.

Automated report on the raw materials to be declared

Based on the supplier responses, Substantio generates a CBAM report on the raw materials to be declared.

This report shows transparently which materials enter the EU from which countries and with which emissions values – and forms the data backbone for the later CBAM declaration.

3.

Mapping with sales and volume data

The next step – and this is the major benefit for you:

The raw material report generated in Substantio can be linked to your own sales and volume data (e.g. from your ERP system).

This allows CBAM-relevant emissions to be allocated to actual import volumes and sold products.

In short:

Substantio helps you collect the key raw material and emissions data from your suppliers, turn it into a structured CBAM report – and provides the foundation for linking this report to your sales figures.

Next steps

for your company

- Identify relevant products and import volumes

- Prepare registration as a CBAM declarant

- Contact suppliers early about origin, processes and emissions data

- Establish processes and tools for a repeatable data and compliance management workflow

You can find the full overview of CBAM – system logic, sectors in scope, obligations and timeline – in our CBAM overview article

Official sources on CBAM

- European Commission, Carbon Border Adjustment Mechanism Taxation and Customs Union

- European Council, Press release, CBAM: Council signs off simplification to the EU carbon leakage instrument

- German Emissions Trading Authority (DEHSt), Understanding CBAM

- Reuters, EU’s carbon cost rules are changing: how companies can prepare for CBAM